ACA Compliance Resource Center

Your starting point for questions about the Affordable Care Act.

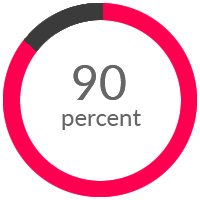

It’s estimated that up to 90% of employers are not prepared to meet the significant reporting requirements the Affordable Care Act (ACA) has imposed. isolved makes your compliance easy.

It’s estimated that up to 90% of employers are not prepared to meet the significant reporting requirements the Affordable Care Act (ACA) has imposed. Employers that do not have a solution for collecting and managing the necessary employee and benefit data to satisfy Section 6055 and 6056 reporting requirements run a significant risk for incurring reporting penalties and ACA excise taxes.

Do you have to comply?

Since the Affordable Care Act (ACA) was enacted in 2010, a number of changes have been made to various ACA requirements that employers and plan sponsors should be aware of. It is important for employers to periodically review their benefit plans in order to maintain compliance with these various requirements.

Part of the ACA requires that any employers with 50 full-time or full-time equivalent (FTE) employees offer full-time employees and their eligible dependents health insurance. This insurance has to be at least what the IRS considers to be minimum essential coverage and it has to be affordable

Whether this is your third ACA filing or your first filing; it’s never a bad idea to review the guidelines for ACA compliance. Especially if you are a smaller company, who is close to the ALE (Applicable Large Employer) threshold.

General reporting requirements

In order to meet the general reporting requirements, employers should already be compiling and analyzing data now to determine coverage and affordability. Required data collection includes:

- Aggregate group membership tracking

- Total employees

- Total FT employees

- Total months covered

- Whether minimum essential coverage was offered, is affordable and meets minimum value

- Employee information including Social Security Numbers or birth dates